YES! We are Registered BAS Agents

and fully qualified to manage your payroll

including ALL your reporting obligations...

BAS Agent Reg. 24722901 and 24701342

Payroll Reporting

One important thing you should be aware of when outsourcing your payroll or reporting obligations is that your outsourced service provider MUST be a Registered BAS Agent or Tax Agent to provide these services.

As a Registered BAS Agent we have met all the qualifications required by the Tax Practitioners Board; and therefore we are able to:

• Prepare Business Activity Statement (BAS)/Instalment Activity Statement (IAS);

• Lodge BAS/IAS on time electronically, avoiding late lodgement penalties;

• Ensure GST is calculated and reported accurately;

• Ensure wages and PAYG Withholding are entered correctly on BAS or IAS; and

• Ensure any instalment amounts are entered correctly.

Payroll Tax

is payable by businesses when their Australian wages reaches what is known as the ‘Exemption Threshold’. Payroll tax is payable to the state based on total wages paid to all employees.

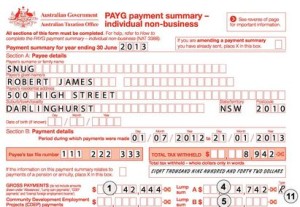

Payment Summaries

Employers must issue all employees with an annual payment summary detailing all earnings and deductions by 14 July of each financial year.

It's important to ensure all amounts are entered into their correct boxes on the payment summary. If an employee has received an Eligible Termination Payment an additional payment summary may need to be issued.

PAYG Withholding

Businesses must withhold a prescribed amount of tax from employees’ wages and from payments made to other businesses if they have not provided their abn on their invoices or other relevant business documents.

All PAYG withholding amounts must be reported on BAS/IAS, the employees' payment summaries and the employers' Annual PAYG Statement return.

Superannuation

Businesses are required to pay a percentage over and above their employees' ordinary earnings into an approved superannuation fund. Employers must ensure the correct rate and amount of superannuation is calculated and forwarded to employees’ nominated superannuation funds at least quarterly. Significant penalties apply for late payment.

It's important to note that all employee superannuation payments must now be lodged and paid electronically in order to be compliant with the new Super Stream legislation effective from 01 July 2015.

Year End Reporting

Year-end reporting for payroll involves the following processes carried out after the final payroll for the financial year has been processed:

• Reconcile end of year payroll to the general ledger;

• Review and fix employee payment summary amounts;

• Check employee payment summaries;

• Enter reportable fringe benefits and lump sum amounts into the payment summaries;

• Publish employee payment summaries;

• Distribute payment summaries to employees;

• Prepare and file the annual payment summary statement report to the ATO.