Get PAIN FREE Payroll - ASK How

The main objective of payroll services is to ensure

employees receive their correct financial entitlements

together with their payslip

following each pay period. It's more complex

than multiplying the number of hours worked

by an hourly rate.

Consider some of the processes involved...

General Payroll Processing

Calculating the correct rate for the correct number of hours worked, including overtime rates and any other special rates and / or allowances in accordance with the applicable award.

PAYG Withholding

Businesses must withhold a prescribed amount of tax from employees’ wages and from payments made to other businesses if they have not provided their abn on their invoices or other relevant business documents.

Superannuation

Businesses are required to pay a percentage over and above their ordinary earnings into an approved superannuation fund. Employers must ensure the correct rate and amount of superannuation is calculated and forwarded to employees’ nominated superannuation funds at least quarterly. Significant penalties apply for late payment.

Entitlements

Ensure that employees’ entitlements are calculated, accrued and paid correctly for annual leave, personal/carer’s leave, long service leave and rostered days off.

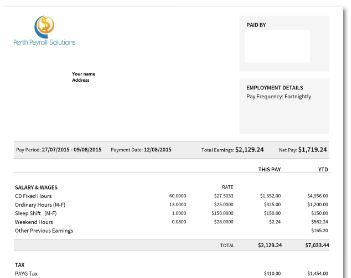

Payslips

must be issued to employees within one working day of their pay day, even when employees are on leave!

Do you know what information you need to include on your payslips?

Check with us if you're not sure!

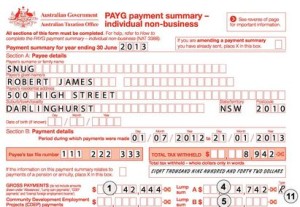

Payment Summaries

must be issued to employees no later than 14 July each year. Did you realise that some employees who have received eligible termination payments must receive a separate payment summary in addition to their normal payment summary?

Eligible Termination Payments

Some termination payments are taxed at special rates and adjustments need to be made for PAYG to ensure employees are paid their correct entitlements on termination. This may also require an ETP Payment Summary to be issued in addition to the normal Individual Non-business Payment Summary.